Resources

Alternative Contact and Agent nomination form

Use this form if you have already submitted a claim for FEG assistance and want to nominate or update an alternative contact or agent.

How do I access FEG IP Online Services Fact Sheet

This fact sheet provides information on making an online claim under the Fair Entitlements Guarantee.

Addressing corporate misuse of the Fair Entitlements Guarantee

Discussion paper released as part of public consultation on addressing corporate misuse of FEG.

FEG Recovery Program – Funding Agreement Fact sheet

FEG advances funds to eligible employees who lose their job through insolvency of their employer on account of the employees’ unpaid employment entitlements. Once entitlements are paid under FEG, the Commonwealth stands in the shoes of the employee as a subrogated creditor and is entitled to claim in the liquidation as a priority creditor over other unsecured creditors under the Corporations Act 2001 (Cth).

Under the FEG Recovery Program, funding is available to liquidators to enable recovery efforts, including legal proceedings, which the liquidators would not otherwise have the financial resources to pursue.

FEG Recovery Program Budget Tool

The Budget Tool is an ancillary document that is completed together with the Funding Application. Its primary function is to obtain a cost estimate for the amount of funding required by the applicant to complete various tasks and activities pertaining to investigations and litigation that are being put forward in the funding application.

FEG Claim Form

This form must be used to apply for assistance under the Fair Entitlements Guarantee Act 2012.

Am I eligible for FEG fact sheet

This fact sheet provides information about the eligibility requirements for assistance under the Fair Entitlements Guarantee.

How do I apply for FEG assistance Fact Sheet

This fact sheet provides information about how to lodge a claim for assistance under the Fair Entitlements Guarantee and the types of supporting documentation that may assist the Department of Employment and Workplace Relations to decide your claim.

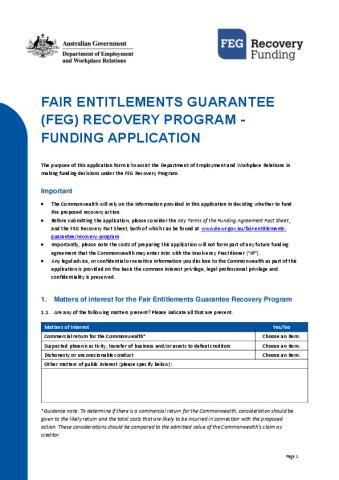

FEG Recovery Program Funding Application Template

Contains information that the applicant is required to fill out in order to complete an application for FEG funding assistance under the program.

FEG Confirmation of Identity and Citizenship

This form may only be used by Aboriginal and Torres Strait Islander people who wish to lodge a FEG claim but are unable to establish that they are an Australian citizen by providing any of the other Mandatory Documents specified in the FEG claim form.

How is tax withheld under FEG Fact Sheet

This fact sheet provides background and explanation of how tax is withheld for advances paid to claimants under the Fair Entitlements Guarantee.

Using FEG IP Online fact sheet

FEG IP Online provides a single online portal for the exchange of information between the Department of Employment and Workplace Relations (the department) and insolvency practitioners (IPs) in relation to claims, verification services, payments and recoveries under the Fair Entitlements Guarantee (FEG).

FEG Recovery Program Fact Sheet

This fact sheet provides information for insolvency practitioners about the Fair Entitlements Guarantee Recovery Program which aims to improve the recovery of employment entitlements advanced under FEG and outstanding superannuation entitlements in insolvent estates where a FEG advance had been made to former employees.

Internal Review of a FEG decision under Section 38 – Application Form

This form should be used if you wish to seek an internal review of a decision under the Fair Entitlements Guarantee. Applications must be made within 28 days of the date of the decision.

Internal Review of a FEG decision under Section 38 – Application Form [Weblink]

How to use FEG Online Services fact sheet

This fact sheet provides a step-by-step guide to using FEG Online Services.

What if I don’t agree with a FEG decision fact sheet

This fact sheet provides general information about your rights for a review of decision under the Fair Entitlements Guarantee.